INTRODUCTION AND BRIEF DESCRIPTION

This section of the Criminal Code of Canada provides a defense for individuals who acted in good faith in the ordinary course of their business or employment.

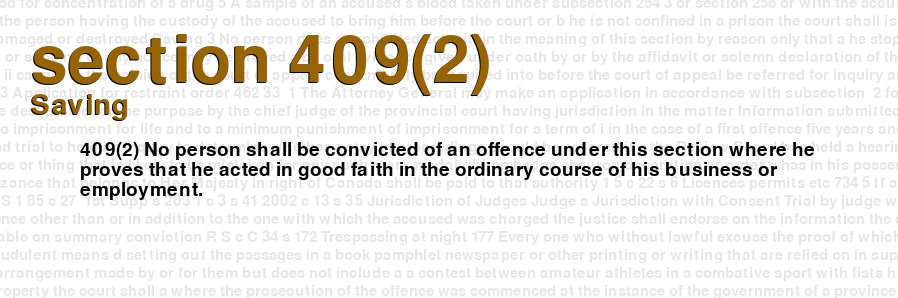

SECTION WORDING

409(2) No person shall be convicted of an offence under this section where he proves that he acted in good faith in the ordinary course of his business or employment.

EXPLANATION

Section 409(2) of the Criminal Code of Canada is a provision that provides a defence to a person charged with an offence under this section. This section is related to offences that involve fraud against the government, including offences related to the misuse of public funds, bribery, and corruption. Under section 409(2), a person cannot be convicted of an offence under this section if they can prove that they acted in good faith in the ordinary course of their business or employment. This means that if a person can show that they did not intend to commit the offence, and that their actions were taken in the normal course of their work, they may be able to escape conviction. The defence of good faith is an important one in the context of white-collar crime, as it recognizes that many people may unwittingly engage in illegal activity if they are not aware of the laws and regulations that apply to their work. This defence is designed to protect people who may have acted in good faith, but who were unaware of the illegal nature of their actions. However, it is important to note that the defence of good faith is not absolute. A court may reject the defence if it determines that the accused person was reckless or willfully blind in their actions. In addition, the defence may not be available if the accused person was aware of the illegal nature of their actions or if they intentionally disregarded the law. Overall, section 409(2) of the Criminal Code of Canada provides an important defence to individuals who may have inadvertently engaged in illegal activity. However, it is important to seek legal advice if you are facing charges under this section, as the defence of good faith may not always be available.

COMMENTARY

Section 409(2) of the Criminal Code of Canada provides an important defence for those charged with an offense under this section. This section prohibits anyone from being convicted of an offence under Section 409 if they can prove that they acted in good faith in the ordinary course of their business or employment. The purpose of Section 409 is to protect people from fraud, forgery, and other financial crimes. The section deals with the offence of fraud against the government, and it covers a broad range of activities such as making false claims, using false documents, and failing to disclose information. The section also covers the offence of forgery, which involves the creation of false documents or the alteration of existing ones. Section 409(2) provides an important safeguard against unfair prosecution and conviction. It recognizes that people can be legitimately mistaken in their actions and that they may not always be aware that what they are doing is illegal. For example, if a person is asked to fill out a government form and inadvertently provides incorrect information, they may be charged with fraud under Section 409. However, if they can prove that they acted in good faith and had no intention of committing fraud, they can use this defence and avoid conviction. This defence is particularly important for businesses and employees who regularly deal with government forms and documents. They may be required to provide information about their operations, finances, and employees, and they may inadvertently provide incorrect or incomplete information. If they can prove that they acted in good faith and were not trying to defraud the government, they can avoid criminal charges and the associated penalties. The use of the defence of good faith in the ordinary course of business or employment is a well-established principle in Canadian law. It recognizes that people should not be punished for honest mistakes or for carrying out their lawful business activities. This defence is also consistent with the broader principles of criminal law, which require the prosecution to prove guilt beyond a reasonable doubt. If a defendant can raise a reasonable doubt about their guilt by showing that they acted in good faith, they should be acquitted. In some cases, the defence of good faith may not be enough to avoid conviction. For example, if the defendant knew or should have known that what they were doing was illegal, they may not be able to rely on this defence. Similarly, if the defendant's actions were reckless or deliberate, they may not be able to rely on good faith as a defence. In conclusion, Section 409(2) of the Criminal Code of Canada provides an important defence for those charged with financial crimes against the government. It recognizes that people can be legitimately mistaken in their actions and that they should not be punished for honest mistakes or for carrying out their lawful business activities. However, this defence is not a blanket exemption from prosecution, and defendants must still demonstrate that they acted in good faith in the ordinary course of their business or employment.

STRATEGY

Section 409(2) of the Criminal Code of Canada provides a defense to charges related to mischief or damage to property if the accused can demonstrate that they acted in good faith in the ordinary course of their business or employment. If an accused can successfully establish this defense, they cannot be convicted under section 409. However, there are several strategic considerations to be taken into account when dealing with this section of the Code. Firstly, the accused must establish that their actions were taken in good faith. "Good faith" refers to exercising honesty, fairness, and moral uprightness in one's actions. This means that the accused must establish that they did not knowingly commit any wrongdoing or harm and that their actions were taken with an honest intention. For example, if a construction company damages a neighboring property while constructing a building, they may be able to establish good faith if they can demonstrate that the damage was the result of an unforeseen circumstance or mistake and not intentional. The accused should gather as much evidence as possible to support their argument that they acted in good faith. Secondly, the accused must prove that they were acting in the ordinary course of their business or employment. This means that their actions must be related to their job responsibilities or the regular activities of their business. For example, if a courier is accused of damaging a package during the course of their delivery, they may be able to argue that their actions were taken in the ordinary course of their employment. However, if the accused was acting outside of their job responsibilities, or their actions were not related to their business or employment, then the defense under section 409(2) may not apply. Thirdly, the accused should consider hiring a criminal defense lawyer who has experience with cases involving section 409(2) of the Criminal Code. Because the defense requires a thorough understanding of the law and how to apply it to specific circumstances, a lawyer can provide valuable guidance and representation throughout the legal process. They can help the accused gather evidence, establish the defense, and present a persuasive argument to the court. Fourthly, the accused should consider negotiating a plea bargain with the Crown prosecutor. Depending on the circumstances of the case, a plea bargain may be a viable strategy for avoiding a criminal conviction. By pleading guilty to a lesser charge or agreeing to a reduced sentence, the accused may be able to avoid the costs and uncertainties of a trial. In conclusion, section 409(2) of the Criminal Code of Canada provides a defense to charges related to mischief or damage to property if the accused can demonstrate that they acted in good faith in the ordinary course of their business or employment. Strategic considerations when dealing with this section of the Code include establishing good faith and ordinary course of business, seeking the guidance of a criminal defense lawyer, and considering the option of negotiating a plea bargain with the Crown prosecutor.