INTRODUCTION AND BRIEF DESCRIPTION

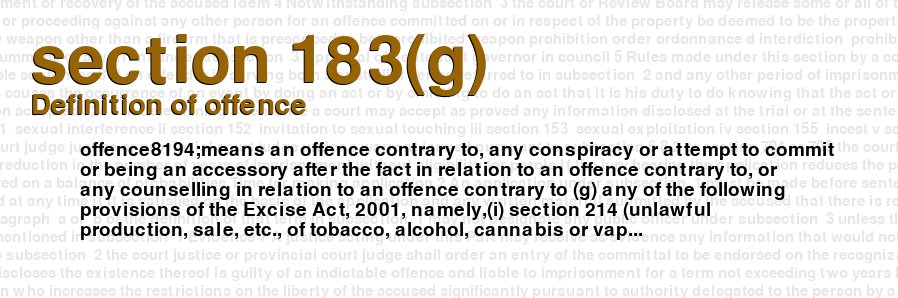

Section 183(g) defines an offense as any conspiracy, attempt, or counseling related to violating specific provisions of the Excise Act, 2001.

SECTION WORDING

offence means an offence contrary to, any conspiracy or attempt to commit or being an accessory after the fact in relation to an offence contrary to, or any counselling in relation to an offence contrary to (g) any of the following provisions of the Excise Act, 2001, namely, (i) section 214 (unlawful production, sale, etc., of tobacco, alcohol, cannabis or vaping products), (ii) section 216 (unlawful possession of tobacco product), (iii) section 218 (unlawful possession, sale, etc., of alcohol), (iii.1) section 218.1 (unlawful possession, sale, etc., of unstamped cannabis), (iii.2) section 218.2 (unlawful possession, sale, etc., of unstamped vaping products), (iv) section 219 (falsifying or destroying records), (v) section 230 (possession of property obtained by excise offences), or (vi) section 231 (laundering proceeds of excise offences),

EXPLANATION

Section 183(g) of the Canadian Criminal Code lists various provisions of the Excise Act, 2001 that constitute criminal offences. More specifically, it refers to acts related to the unlawful production, possession, sale, or transportation of tobacco, alcohol, cannabis, or vaping products, as well as the falsification or destruction of records and the possession of property obtained through related offences. The section also outlines the scope of criminal responsibility by including not only the primary offender but also individuals who conspire, attempt, or counsel the commission of such offences, or who help conceal them after the fact. The Excise Act, 2001 is part of Canada's federal legislation concerning the taxation and control of certain goods. Its aim is to regulate and secure the collection of taxes on products like tobacco, alcohol, and cannabis. Section 183(g) recognizes that certain actions related to these products, such as producing them without a license or evading taxes on them, can have broader implications for public health and safety beyond tax evasion. For instance, the unlawful production of cigarettes could result in poor quality and unsafe products that could harm consumers. Similarly, the sale of alcohol or cannabis to minors could have harmful effects on their physical and mental health. Overall, Section 183(g) highlights the importance of regulating excisable goods and penalizing those who engage in illegal activities related to them. The section also emphasizes the need to hold individuals accountable for not only committing these crimes but also for aiding, abetting, or benefiting from them in any way. By doing so, it aims to prevent illicit activities related to excisable goods and maintain proper public health and safety standards.

COMMENTARY

Section 183(g) of the Criminal Code of Canada criminalizes offences relating to the Excise Act, 2001. The Excise Act is a federal law that governs the production, sale, possession, and taxation of various goods, including tobacco, alcohol, cannabis, and vaping products. The offences listed in Section 183(g) include unlawful activities related to these goods, such as production, sale, possession, and trafficking, as well as money laundering and falsifying or destroying records. The purpose of Section 183(g) is to deter and prevent illicit activities related to excisable goods, which pose significant risks to public health and safety, as well as government revenue. The unlawful production, sale, and possession of excisable goods can lead to increased consumption, particularly among children and vulnerable populations, as well as exposure to harmful contaminants and substances. The taxation of excisable goods is an important source of government revenue, which funds essential public services such as healthcare, education, and infrastructure. To achieve its objectives, Section 183(g) provides a broad range of offences, including conspiracy, attempt, being an accessory after the fact, and counselling, which can be charged in relation to any of the offences listed in the Excise Act. This means that individuals who are involved in any aspect of the illegal production, sale, possession, or trafficking of excisable goods, as well as money laundering and record falsification, can be prosecuted under Section 183(g). The penalties for offences under Section 183(g) can range from fines to imprisonment, depending on the nature and severity of the offence. For example, the unlawful possession of tobacco products under section 216 of the Excise Act can result in fines of up to $10,000 and imprisonment for up to six months for a first offence, while the unlawful production, sale, or possession of cannabis under section 214 can result in imprisonment for up to 14 years. In addition to criminal sanctions, Section 183(g) also provides for civil remedies, including forfeiture of property, which can be used to deter and disrupt criminal activities related to excisable goods. The forfeiture provisions allow for the seizure and forfeiture of property that is used in or derived from the commission of an offence under Section 183(g), including vehicles, equipment, and proceeds of crime. Overall, Section 183(g) of the Criminal Code of Canada plays an important role in protecting public health and safety, as well as government revenue, by criminalizing a broad range of offences related to excisable goods. By providing for criminal and civil sanctions, it helps to deter and prevent illicit activities in this area, and contributes to the effective enforcement of the Excise Act, 2001.

STRATEGY

Section 183(g) of the Criminal Code of Canada targets offences related to the Excise Act, 2001. This section establishes that anyone who conspires to commit, attempts to commit, or is an accessory after the fact to an offence contrary to the Excise Act, 2001, can be charged with an offence. Similarly, anyone who counsels others to commit an offence under the Excise Act, 2001, can also be charged. Given the seriousness of these offences, it is essential to consider strategic approaches to dealing with this section of the Criminal Code of Canada. One strategic consideration is to ensure that any conduct or behaviour being considered does not fall under the provisions outlined in Section 183(g). The best way to avoid these offences is to stay away from the unlawful possession, sale, production, or distribution of tobacco, alcohol, cannabis, and vaping products. Anyone involved in these activities should stop immediately to avoid legal consequences such as fines and imprisonment. Another strategic consideration would be to ensure compliance with the Excise Act, 2001. This means every activity related to the production, distribution, and sale of tobacco, alcohol, cannabis, and vaping products must adhere to all legal requirements. For example, registered producers should obtain and use excise stamps on tobacco products, among other things. Enterprises must also keep accurate records and ensure transparency in their business dealings. These actions would help prevent charges under Section 183(g). A company or individual charged under Section 183(g) must take certain strategic steps to protect their interests. First, it is advisable to contact an experienced criminal defense attorney. An attorney would help understand the charges and provide advice on the available options. An attorney can also help determine essential facts that may lead to reduced charges or acquittal. Similarly, establishing a good relationship with regulatory agencies can prove beneficial. Companies or individuals found to be in violation of the Excise Act, 2001, may face sanctions or fines. However, being cooperative and transparent with regulatory bodies may help mitigate such penalties. Regular compliance can help improve relations with such agencies, which may be beneficial in case of legal complications. In summary, the Excise Act, 2001, plays a vital role in Canada's economic and regulatory landscape. Dealing with Section 183(g) of the Criminal Code of Canada requires strict compliance and adherence to all legal requirements. Strategic considerations such as ensuring compliance and seeking legal assistance when required can help mitigate legal and economic risks associated with violations of the Excise Act, 2001.